Innova: 2022 Year in Review

With Covid lockdowns seemingly in the rear view, most people began the year with optimism…but 2022 had other plans. It saw what 2021 threw at us, then said ”hold my beer”. Three of the four Horsemen of the Apocalypse joined us within the first three months of 2022, War in Ukraine, Pestilence with Covid and Famine due to rising food prices and disrupted supply chains, while plenty of potential bad guys ready to embody the fourth.

Similarly, this past year was one of ups and downs for Innova. Thanks in large part to the success of the Tactical Asset Allocation Private Pool and the depth of our planning, we continue to experience exceptional growth by means of referral. It was also the first year in which Innova become outward facing, moving from word-of-mouth marketing to conventional advertising. In large part, this move was part of broader plan to continue to gain investment scale, which would allow us to reduce fees, increase the number of strategies we can offer, and further specialize our team members across our core services.

Two Steps Forward, One Step Back

We began the year by filling three newly created positions focused on growth, with high hopes for what these young people could accomplish in our firm. For a variety of reasons, it did not go as planned and we were left with time sunk into training but without the additional manpower to show for it. This resulted in an added workload for our team members, who have all felt the pressure of balancing growth and maintaining the standards of service we set out for ourselves. In retrospect, our team was stretched too thin – a feeling that is likely familiar to most of you, especially those with small businesses. We are currently in the process of adding at least two more team members who will be focused on internal operations before we return our focus to growth.

Despite these hurdles, we as a firm accomplished considerable work behind the scenes on some of our best practices and internal controls in 2022. We also launched our second pooled fund, the Innova Enhanced Growth fund to serve as a compliment to our more conservative Tactical Pool. Buying Tesla 50% off its peak seemed like good timing to launch a growth-oriented product but alas, with the benefit of hindsight, deferring our launch a few months would have been great for the long-term track record!

As a firm, we retained all our households in 2022 (Thank you for your continued trust!) and have added a record number of new clients (Thank you for your referrals!), growing our total investments under management to more than $375M despite the difficult market conditions.

Looking Forward

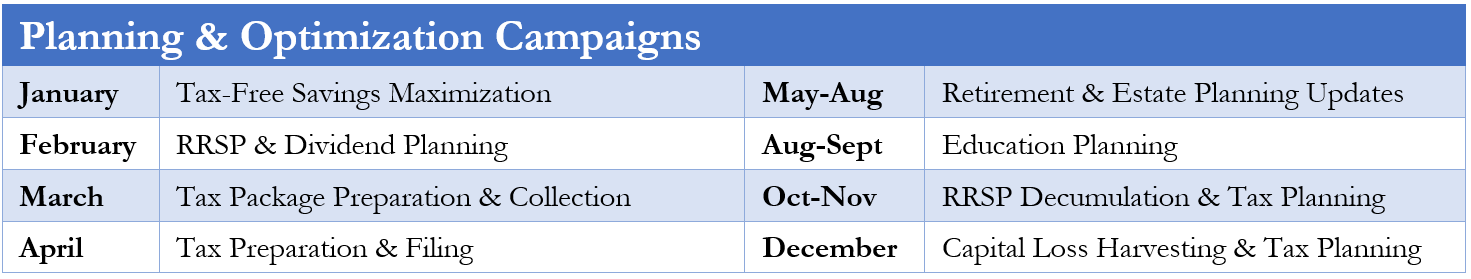

We now turn our attention and focus to 2023, which should be an equally interesting year for Innova and our valued clients. Over the next few weeks, our team will be focused on planning activities, including Tax-Free Savings Account Maximizations, RRSP Contribution Planning, and Cash Flow & Dividend Planning. This campaigns are in-line with the annual planning calendar we have shared with you in previous years:

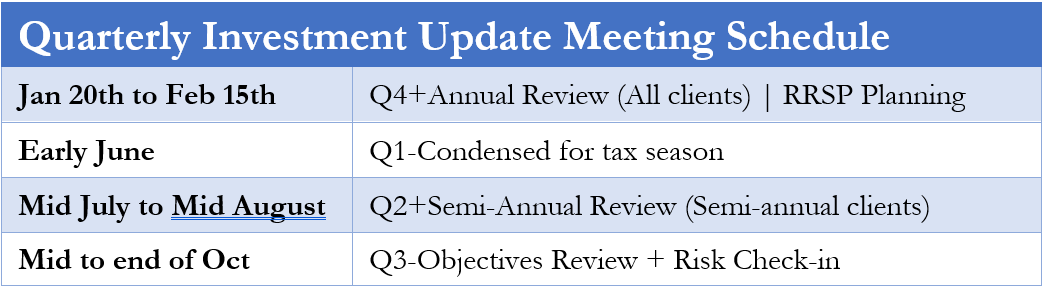

Following the initial planning push, we will resume our quarterly investment updates:

Good things on the horizon

Perhaps one of the most significant changes we expect to see in 2023 will be a shift in our custodial relationship. At present, all investment accounts are housed at National Bank – whose service standards are beyond our zone of control. This situation can sometimes lead to frustrating delays for our team, as well as sub-par client statements, among others.

We are hopeful that by this time next year, your investment statements, both online and off, will be greatly improved. Internally, substantial investment is being made in this new platform with hopes of providing significant operational efficiencies for our team, allowing us to focus more time on client service and less on legacy systems. We will share more with you as we progress.

Internally, our focus continues to be on combining advanced planning and investment expertise. Along with ensuring that your financial objectives are in line with your investment policy, we have broadened our scope to include estate planning and even charitable giving planning, as discussed in this Financial Post Feature:

Further, we are pleased to expand our offerings in inter-generational wealth consulting. The children of Innova clients can access our comprehensive planning and investment solutions without being subject to investment minimums, and households can be grouped to benefit from fees. Those with children looking to enter the real estate market may want to give Laura Schmidt's article on the new First Home Savings Account (FHSA) a read.

Lastly, we intend to share a client survey in the coming months to ensure that we continue to meet your needs and exceed your expectations, and course correct where needed. We remain committed to ensuring that our near-perfect retention rate stays that way – so please do not hesitate to communicate with us what we are doing well, and what we could improve on.

We greatly value our relationship with you and appreciate your continued trust in our team. Thank you and all the best in 2023!

- Hits: 7654