Steady Through the Storm: Navigating Markets in Changing Times

We live in a time of turbulence. Over just the last few months, the world has been buffeted by ongoing wars, tariff escalations, geopolitical fractures, renewed resource nationalism, and more. The IMF recently warned that “uncertainty is the new normal,” and with good reason.

- The U.S. has ramped up its tariff drama, hitting trading partners and threatening further escalation.

- China and India are pushing back with retaliatory trade measures of their own.

- Supply chain stress is now compounded by critical mineral constraints—many essential inputs are heavily dependent on China.

- Global energy markets remain volatile, particularly with Middle Eastern flare-ups and shifting OPEC+ dynamics.

- In Canada, policy shifts, trade pressures, and questions over interprovincial barriers are intensifying business uncertainty.

Taken together, these are not ordinary headwinds. But despite the noise, your portfolio was built for times like these. In this Innova Market Insights newsletter, we walk through where we see the risks and opportunities, and how we're keeping the ship steady through the turbulence.

Market Update

Following an exceptional twelve months of positive stock markets, many are questioning whether or not the markets have grown too expensive, with the dreaded ‘Bubble’ word being through around. It’s worth revisiting why valuations matter. Over the long term, the price investors are willing to pay for a company’s earnings, or for the market as a whole, is one of the strongest predictors of future returns. Put simply, when valuations are high, much of the good news is already reflected in prices. Future gains tend to be smaller because expectations leave less room for upside. Conversely, when valuations are low, markets are often pricing in pessimism, and future returns can be stronger as sentiment improves and earnings recover.

One of the most common ways to measure valuation is through the Price-to-Earnings ratio, or P/E ratio. This figure compares the current market price of a company (or an index) to the amount of profit it generates per share. If a company has a P/E of 20, investors are paying $20 for every $1 of its annual earnings. A higher ratio suggests investors expect stronger growth ahead, while a lower ratio can signal undervaluation or slower prospects.

When applied to the broader market — like the S&P 500 — the P/E ratio offers a snapshot of investor optimism or caution. Historically, the S&P 500 has traded at an average multiple of around 17× earnings. Today, however, that figure sits closer to 30–31×, nearly double the long-term norm.

More chilling is the cyclically adjusted PE Ratio, also known as the Shiller P/E named after its Nobel prize winning creator, Robert Shiller, which seeks to determine if a market is overvalued or undervalued by smoothing out business cycle volatility:

Source: https://www.multpl.com/shiller-pe

This matters because valuation extremes tend to correct over time. That reversion can happen in one of three ways:

- Stock prices fall

- Profit growth accelerates dramatically

- Prices stagnate while earnings catch up over time

Are lofty valuations justified by the potential productivity boost that AI might bring? Although many are drawing parallels between the 2001 Dot-Com bubble and today’s lofty prices, we do not believe the comparison is necessarily fair. At that time, companies involved in the dot-com bubble were purely speculative, with very few showing net profits. The tech behemoths of today have diversified streams of income, innovate in-demand products and solutions, and generate significant amounts of positive cash flow.

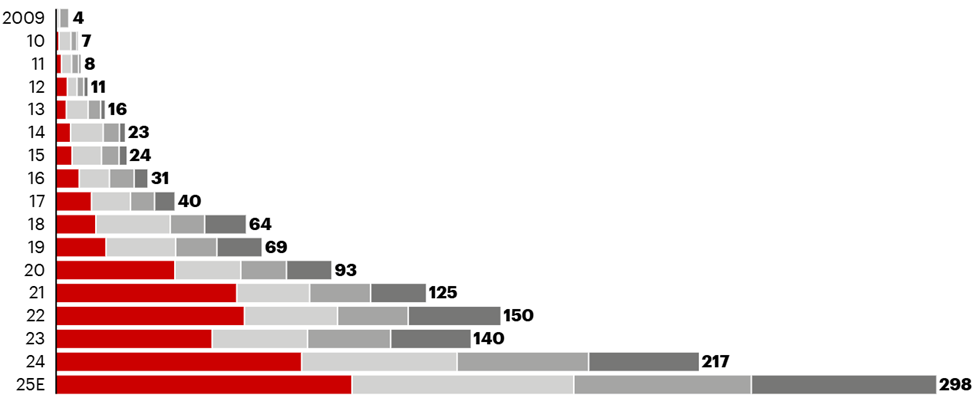

If a bubble exists, it is in the spending on artificial intelligence research. Data centers, microchips, and wages spent in this space have reached stratospheric figures without a clear indication as to whether it will ever pay-off, or not:

Notes: Company data based on fiscal years (ending December 31 for Amazon, Alphabet, and Meta; June 30 for Microsoft, in order above); forecast values are from earnings calls. Source: Bain & Company. 9/23/2025.

To their credit, many leading tech firms are funding this with cash flow from existing operations rather than debt. For example, Microsoft spent ~$64B in capital expenditures (FY ending June 2025) while generating $136B in operating cash flow. The difference? They’re spending money they already have, which is far more sustainable than relying on leverage.

We avoid placing blanket bets on “AI companies.” Instead, we assess each business on how this wave of technological transformation in automation, machine learning, and digital tools will shift its margin structure, competitive moat, and capital requirements. That’s why we are favouring more active security selection in our portfolio at present. Rather than believing that P/E ratios will revert to their mean through price correction, we believe that companies able to embrace this technology stand to see profits rise enough to justify higher stock prices (Option 2 above).

Our excitement over what this transformational technology could mean for company profitability has led us to take a modest overweight in equities, which now sit at 42% as of September 30th, up from 34% this time last year, not out of blind optimism, but because the potential value creation is real.

The New Normal?

On the other hand, we remain extremely underweight bonds and fixed income. This isn’t a contrarian stance for the sake of it, it’s based on a genuine concern about inflation and the real returns these instruments can generate going forward.

We believe we are in the early stages of a monetary paradigm shift in how governments and central banks approach inflation. At a time when public debt levels have become unsustainable, there are really only two viable paths forward to restore balance that don’t involve defaulting on debt:

Option 1: Enforce fiscal restraint, opting for years of austerity and balanced budgets to gradually repay the debt.

Option 2: Tolerate a higher level of inflation, allowing the real value of that debt to erode over time.

Interestingly, the 2% inflation target, now treated as an economic commandment, is a relatively recent invention[i]. It emerged less than 30 years ago and is not grounded in any specific body of research. In truth, it’s closer to the modern-day version of Goldilocks’ porridge, believed to be: not too hot, not too cool.

We believe momentum is quietly building toward abandoning the rigidity of the 2% target in favour of a slightly higher, more flexible inflation range, driven by the economic and political realities of debt management.

In a world of persistently higher inflation, capital must be put to work productively to preserve purchasing power. Savings left in low-yield accounts or conventional fixed income will suffer a slow, steady erosion—the silent taxation of idle capital. We believe we’ve entered a phase of cycle where bond yields are unlikely to experience enough downward pressure to deliver after-tax returns that outpace inflation. In other words, bonds may no longer offer “real” (after-inflation) protection for investor capital.

As a result, bond allocations stood at less than 7% as of September 30th, 2025, down from roughly 20% last year. For context, most traditional retirement-focused balanced funds still maintain 30-40% exposure to fixed income, relying on the old assumption that bonds act as a ballast to equities. Our concern is that this long-standing negative correlation between the two may not hold up when investors need it most.

Geopolitics, Policy, and Risk

Perhaps no risk looms larger right now than the unraveling norms of global trade and governance. The U.S. seems increasingly willing to weaponize trade, ignore international norms, and override its own institutions. A nation once defined by its commitment to free markets, the rule of law, and democratic compromise now risks eroding those very foundations. Tax cuts for the wealthy, funded by ballooning deficits; political influence over media and public institutions; and open conflicts of interest at the highest levels—these are the hallmarks of crony capitalism, and they’ve rarely ended well in history. Sadly, we may be facing the early signs of an empire in decline.

While we remain hopeful that this period of political turbulence in the U.S. will prove temporary, we must still consider its potential impact on global markets. The United States represents over 60% of global stock market capitalization—what happens there reverberates everywhere.

From a portfolio standpoint, we’ve taken steps to reduce exposure to these structural risks.

- First, our Tactical Pool holds no U.S. government debt, insulating us from the fiscal challenges facing that country.

- Second, our U.S. exposure comes primarily through global companies headquartered or listed in the U.S., many of which are the same highly profitable, innovation-driven firms benefiting from the AI transformation.

- This focus on international players based in the U.S. has the bonus of providing some protection against a falling $USD, as companies earning revenues in foreign currencies will see a surge in profitability should the American dollar falter.

The trade actions against Canada and Mexico, and the increasingly aggressive stances toward China and India, may mark a turning point in international cooperation and trade. Governments everywhere are flexing control over resources, prioritizing strategic autonomy, and working to strengthen supply chain resilience.

In Canada, these global shifts hit close to home. Our exports, energy sectors, and even interprovincial trade face new political and policy headwinds. Yet we see this as an opportunity. Canada has the resources, engineering expertise, and geographic advantage to thrive, but only if we choose to act.

We must move decisively to develop the infrastructure required to remain relevant in tomorrow’s economy. Energy independence, food and water security, and access to critical minerals could make Canada an important geopolitical player, but we currently lack the infrastructure to cost-effectively access, extract, process, and export these resources to markets beyond the United States.

We view this as a generational opportunity to secure Canada’s future role in global affairs. Local and provincial interests must be willing to set aside self-interest for the greater good if we are to seize this moment.

Positioning Capital for a Changing World

With this backdrop, we’ve worked deliberately to diversify away from the traditional equity–bond model by incorporating asset classes that can deliver returns even amid geopolitical and economic uncertainty. These investments form the counterweight to our bullish stance on AI-driven growth.

At the defensive end of the portfolio, physical gold bars, securely stored in Canadian vaults and available for on-demand delivery, have anchored our holdings since September 2024.

As part of investing in Canada’s future, we continue to increase our allocation to infrastructure assets including power generation, gas storage, pipelines, and transportation networks, all real-world projects that produce tangible revenues, often indexed to inflation. Alongside these, we’ve maintained exposure to income-producing real assets such as apartment buildings, long-term care homes, and storage facilities, which have consistently demonstrated resilience through economic slowdowns.

A Barbell Approach

Balancing our optimism about corporate innovation with our caution about macroeconomic and geopolitical risk, we’ve adopted what we call a “barbell” strategy. On one side of the barbell are our “risk-on” investments—the companies best positioned to harness the power of artificial intelligence and long-term technological change. On the other side are our real assets like gold, infrastructure, and income-producing holdings—that provide ballast, stability, and income regardless of market conditions.

All the while, we remain nimble. When markets dip, we incrementally add. When rallies offer outsized gains, we lock in. This isn’t day trading—it’s opportunistic risk management. We’re also carefully stress-testing every position for inflation, currency volatility, shifting trade policies, and capital constraints.

This positioning, we believe, allows us to prosper across a range of environments—participating in growth when opportunities arise, while maintaining the fortitude to weather whatever storms may come.

Final Thoughts & A Steady Hand

We are indeed living in “uncharted times”, but history shows that turning points are often misunderstood in the moment. The high-stakes environment demands discipline, courage, and adaptability. That’s precisely what your team brings every day.

We’re not chasing headlines or riding momentum for its own sake. We’re anchored in fundamentals, diversified across real assets and growth opportunities, and prepared to pivot when conditions shift. I look forward to connecting with many of you in the coming weeks to review your plan. In the meantime, don’t hesitate to reach out with questions or thoughts.

Thank you for your continued trust. Through calm seas and stormy waters, we remain resolute at the helm, charting a course toward your financial goals.

[i] https://www.reuters.com/markets/mouse-that-roared-new-zealand-worlds-2-inflation-target-2023-01-30/

This publication is for informational purposes only and shall not be construed to constitute any form of advice. The views expressed are those of the author alone. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

- Hits: 1565